The Key to Fundraising – “Know Thy Donor!”

Building strong donor relationships is crucial for successful fundraising. This post explores the importance of knowing your donors deeply, scheduling regular outreach, and creating personalized donor management plans. Discover practical tips for engaging with major donors, from face-to-face meetings to thoughtful listening, and learn how to keep them motivated to give again and again. Don’t treat your donors like ATM machines—invest in relationships for sustainable support.

No Time for Data? The Fundraiser’s “Fail”

Neglecting donor data can be a critical mistake for fundraisers, especially for nonprofits with limited staffing resources. This post emphasizes the importance of using affordable fundraising tracking software to keep organized records of donor gifts and interactions. Discover how making time to understand your donors’ giving habits can enhance donor retention and increase donations. Engage with your donors, appreciate their support, and avoid the common fundraising "fail" of ignoring valuable donor data. Let's talk about how you can improve your donor stewardship and boost your fundraising success.

Gearing Up for Your Nonprofit’s Year-End Fundraising Appeal

Preparing for your nonprofit's year-end fundraising appeal starts early. Learn how to effectively plan your editorial calendar, craft compelling solicitation letters, and build a series of engaging emails and social media posts. Discover storytelling techniques and expert tips to keep your donors engaged and maximize your year-end fundraising success. If you need help editing your communications, reach out through our contact form.

The Importance of Giving Tuesday

Giving Tuesday is a big day for nonprofits around the country!

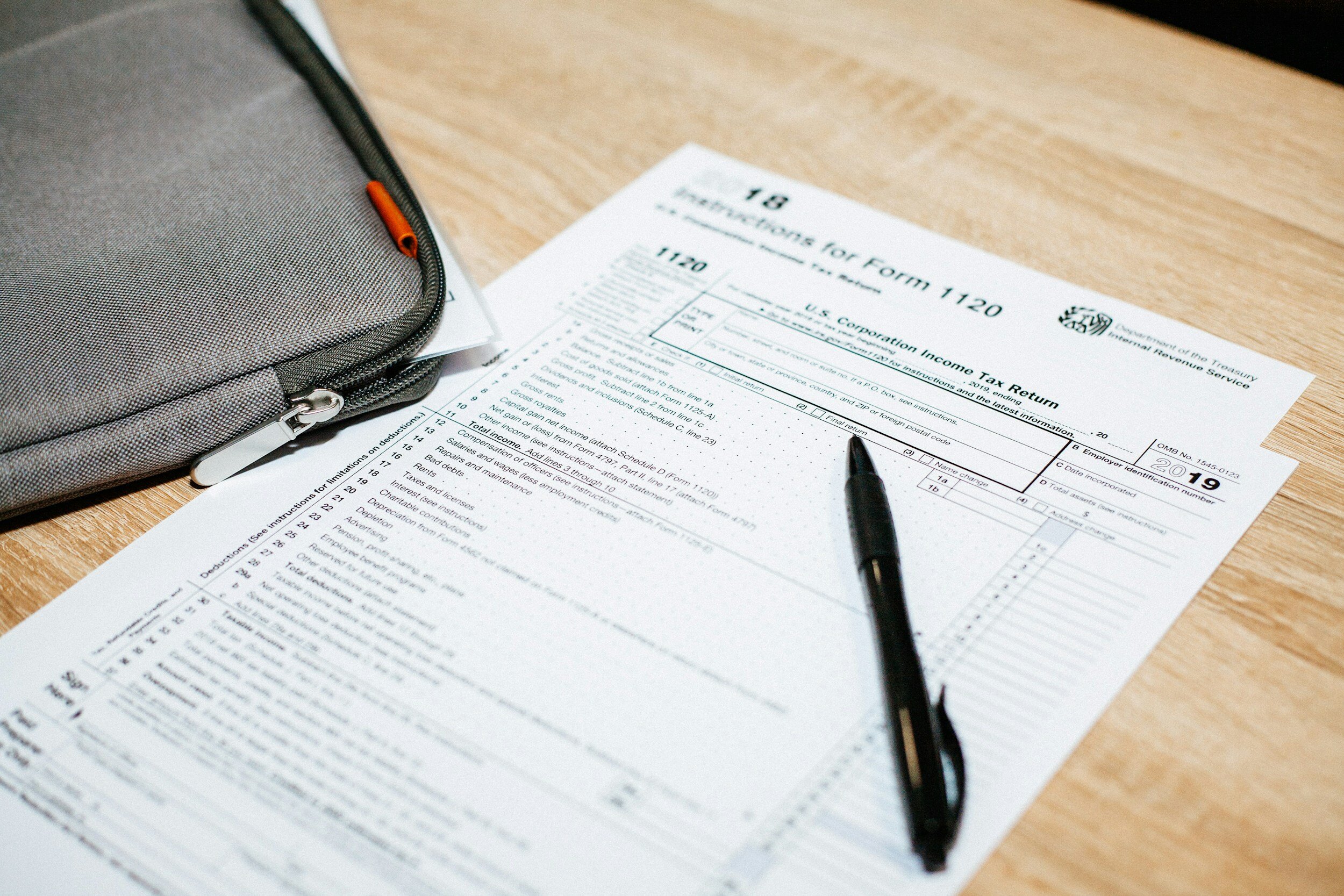

Educate Your Donors About Giving Under New Tax Rules

Many donors and nonprofit organizations waited to see the tax implications of making charitable gifts since the standard deduction increased to $12,000 for singles and $24,000 for couples last year. For 2019, it will increase to $12,400 and $24,400 for couples.

How Will The New Tax Laws Impact Nonprofits?

Many nonprofit staff and donors wonder if the tax law changes taking effect in 2019 will impact charitable giving. My analysis and reading tells me that the consensus says “no.” Why?